Real Estate rehabbing can be a great short-term investment for your portfolio.

Today I’m going to speak with you all about rehabbing real estate properties in Denver and Colorado Springs Colorado.

This is our companies go-to exit strategy because it is the most profitable to reach our short-term goals. If you choose this as a strategy that you want to use again and again, you must dedicate time to learning how to rehab properties and manage contractors. Try to get some hands-on experience at an actual job site if possible. If you put the time into learning the ins and outs of this style of investing, it will most likely prove to be one of your biggest cash generators. As I’ve mentioned in previous videos, I had some knowledge in this area before I started real estate investing running a company that did property preservation. The work I was doing was more pre-habbing than rehabbing.

The only way to increase your probability of success in real estate rehabbing is to study the entire process!

So that’s what we began to do. We even went so far as to hire a contractor to be our mentor. He flew to meet us on a deal we had in FL to inspect the properties we were interested in and also show us the best ways to inspect a property. It was a good learning experience overall. If you are a new investor, try starting off with smaller rehabs, they are some of the easiest deals to complete. Their profit margins are larger than wholesaling, which is usually how new investors tend to start. But remember, you do end up waiting months to get your profit as you are waiting for the contractors to finish the rehab and then selling of the property. Not to mention, complications can occur with the rehab process causing a delay in your payday. So again, if you are a new investor try to work on smaller projects until you increase your knowledge and confidence. Then go out and take on the larger and more profitable projects.

I’m going to conclude this video by breaking down the entire rehab process into steps to perform. This will allow you to spend less time on the job site, and more time finding your next property to flip.

Step 1 is to develop a Scope of Work, which is a step-by-step checklist for the contractors that itemizes exactly what has to be done throughout the entire property.

Step 2 is to get bids on the work to be done and then selecting your contractor. Always bring in multiple contractors to bid on your projects. Establish clearly with them that you are not just a retail customer.

Step 3 is Contract Communication at signing. Never start rehabbing a property without filling out the proper paperwork to protect yourself as the investor.

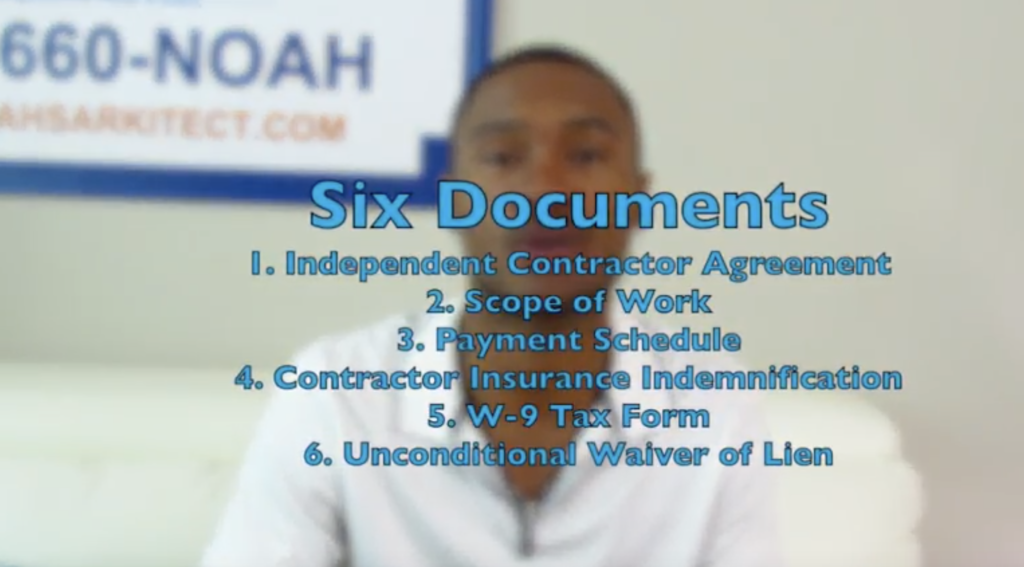

Step 4 is to get signatures on the following 6 documents that are critical towards staying compliant.

Here is a list of the six documents you need to protect yourself when dealing with contractors:

Independent Contractor Agreement – Scope of Work – Payment Schedule – Contractor Insurance Indemnification Form – W-9 Tax Form – Final and Unconditional Waiver of Lien.

Step 5 is simple to manage the rehab process which can either be simple or not so simple at all depending on the quality of contractor you choose and your relationship you build with them.

Step 6 is when you do the final walkthrough and make the payment to the contractor. This step is closing out the property.

Step 7 is preparing the property to sell. Clean it, stage it, sell it quickly!

Hopefully, this was helpful to everyone. Continue to learn and grow with us. Our purpose with this channel is to share real estate investing content so that someday you can invest successfully. This is Courtney Thomas of Noah’s Ark Investments, and we’re here to help set sail to a better financial future.